Thinking about buying a home this year?

It’s the time of year for me when I receive two types of calls:

- Buyers who have decided that THIS is the YEAR to finally buy the house they have been dreaming about.

- Sellers who want to put their house on the market this SPRING.

The buyers are ready NOW, the sellers may not be ready until April – see the problem? So, as a buyer, take this time to really get yourself ready for the process. Read on for two questions you should ask yourself, along with answers from some reputable experts (including me!). Where Are Home Prices and Mortgage Rates Headed?

1. Where Are Home Prices Headed?

There are many news outlets that you could refer to for information on home price predictions. One important thing to keep in mind is that headlines are intended to grab the reader’s attention and pull them in – often there’s only a shred of truth in what you read. So, instead of going it alone, let us be your resource.

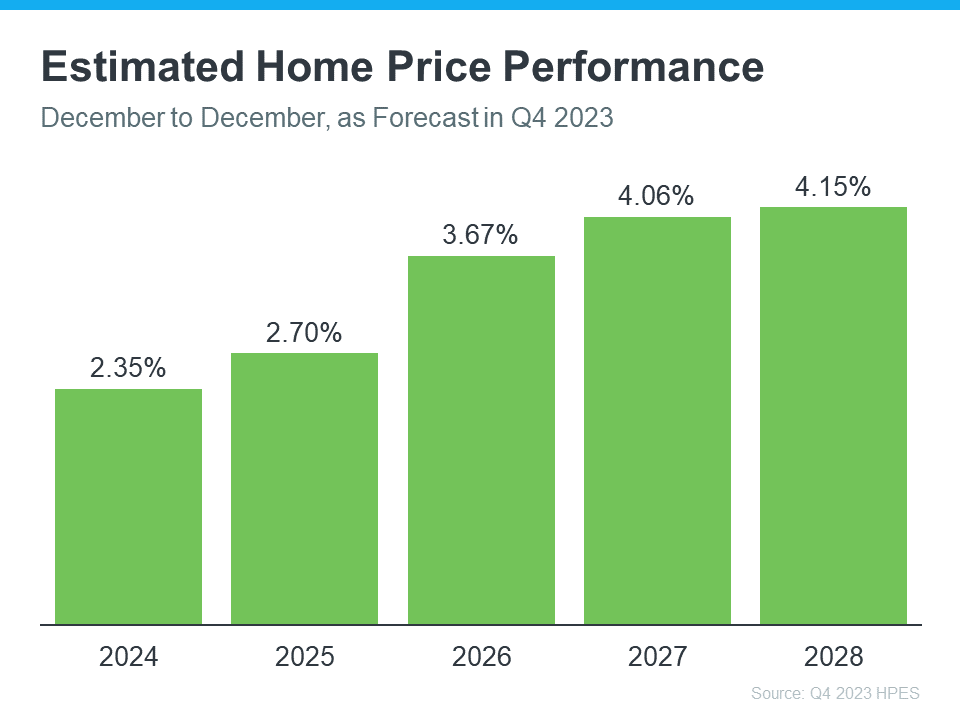

We look at Home Price Expectations Survey on a pretty regular basis. Fannie May survey’s over 100 economists, real estate experts and investment strategists. They are currently predicting that home prices will continue to rise through 2028 – at a “normal” pace of approximately 4.0%.

The take-away here is this: if you wait to buy real estate, you will definitely pay more – especially if interest rates come down. If you buy now, you will enjoy increasing equity for the next FIVE years!

2. Where Do I Think Mortgage Rates Are Heading?

We have seen mortgage rates rise steeply in the last year. This was due to inflation, economic uncertainty, political strife and more. BUT – there are some really strong signals that mortgage rates will be coming down throughout the course of this year. Inflation has cooled a bit, and the Federal Reserve has indicated that they are pausing their Federal Funds Rate increases and might even cut rates in 2024. These are really good signs! Keep in mind though – as interest rates fall, affordability rises and so will the number of buyers in the market. This will increase competition if supply doesn’t not go up to satisfy demand.

Notable quotes:

- Danielle Hale, Chief Economist at Realtor.com, says: “. . . mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer. . . . a key factor in starting to provide affordability relief to homebuyers.”

- An article published by the National Association of Realtors says, “Mortgage rates likely have peaked and are now falling from their recent high of nearly 8%. . . . This likely will improve housing affordability and entice more home buyers to return to the market . . .”

In Summary:

If you are thinking about buying a home, these datapoints should be reviewed regularly so that you stay on top of what is happening in the market. So where do you think Home Prices and Mortgage Rates are Headed? The Blanchard Team keeps abreast of this information as we live and breathe, and we are happy to be your real estate resource as you embark on this journey. We work at YOUR pace not ours – and we recognize that we have information you need to make the best decisions for YOU and we love to share! So never hesitate to reach out to us. Or learn more here.

Jennifer Blanchard Team

Berkshire Hathaway Fox and Roach HomeServices NJ Properties