Are you holding off on purchasing a home, hoping that interest rates will drop? It’s a common strategy, but it’s important to carefully consider the relationship between interest rates and home values before making a decision.

The Relationship Between Interest Rates and Home Values

Interest rates and home value appreciation are closely connected. When interest rates fall, the demand for housing typically increases, which can drive home values higher. This means that while you might secure a lower rate in the future, you could end up paying more for the home itself.

Many homeowners are currently locked into low 3-4% interest rates and are hesitant to sell, which further limits housing inventory. This scarcity often leads to increased home prices as demand outpaces supply.

The Cost of Waiting for a Rate Drop

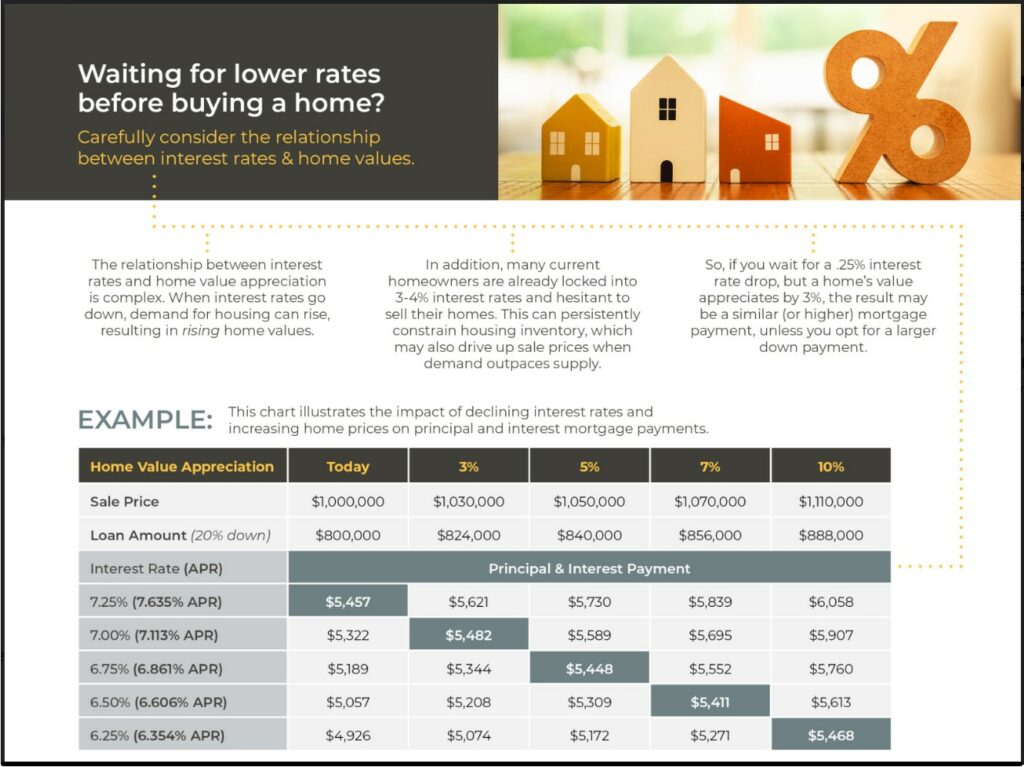

Let’s break down why waiting for a small decrease in interest rates could end up costing you more. If you wait for a 0.25% interest rate drop but, in the meantime, the home value appreciates by 3%, your monthly mortgage payment may actually increase. The chart below illustrates this concept with a $1,000,000 home purchased with a 20% down payment:

As you can see, even a slight increase in home value can offset the benefits of a lower interest rate. If you wait and home prices increase, you might find yourself paying a similar or even higher monthly payment than you would have if you purchased the home today at the current rate.

BOTTOM LINE

Timing the market is challenging, especially when it comes to interest rates and home prices. Instead of trying to predict future interest rates, focus on finding the right home within your current budget. As this example shows, waiting for a small drop in rates while home prices continue to rise might not be in your best financial interest.